Why Companies Need to Stop Rebranding ESG

The annual World Economic Forum summit (aka Davos) that just concluded provides an interesting snapshot of the issues shaping the collective agenda of the world’s most influential figures in business, politics, academia, NGOs, and media. One topic was noticeably absent at the 2024 summit: ESG, or environment, social, and governance. The phrase ESG appeared zero times on the 2024 content program. Davos is a microcosm of a bigger problem: businesses are shying away from using the term. As they struggle to find another way to discuss their commitment to ESG without using the term ESG, they’re muddying their communications outreach to investors. This makes it harder for shareholders to understand how businesses are managing ESG risks, which is bad for businesses.

A War of Words

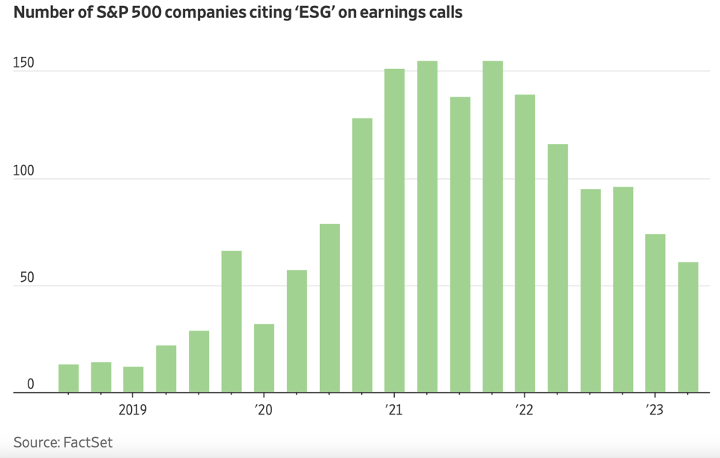

Davos is not the only place where the term ESG has fallen out of favor even as businesses maintain their commitment to ESG (especially the environmental aspect, aka sustainability). According to a January 2024 Wall Street Journal article (fittingly entitled “The Latest Dirty Word in Corporate America: ESG”), 155 companies in the S&P 500 mentioned ESG initiatives in the fourth quarter of 2021, but only 61 did so by the second quarter of 2023.

Why? Well, it’s not because companies are scaling back their ESG efforts – as reported in The Wall Street Journal, 92 percent of CEOs intend to stay the course with ESG. But they are grasping for different words to describe ESG, such as “responsible business.” Some are not even talking about ESG at all.

This is because ESG has become a political hot potato in the United States, which is in the midst of a presidential election year. Businesses just do not want to deal with the headache of mollifying vocal influencers with a political agenda. Since the U.S. companies influence a vast amount of capital flowing around the world, this battle has global consequences.

Bad Timing to Stop Using the Term ESG

Moving away from the term ESG in public reporting is a poorly timed mistake. Investors care about ESG more than ever, and they want to know more, not less, about how businesses manage the risks associated with ESG. Governments around the world are increasingly requiring companies to disclose their ESG performance, which means businesses need to do a better job reporting on ESG, not hide the term. This is making it easier for investors to compare companies and identify those with the best ESG practices. For instance, the EU’s Corporate Sustainability Reporting Directive (CSRD), which comes into effect in 2024, will require all large EU companies to report on their ESG factors. Similar rules are eventually coming to the United States.

Investors need companies to continue talking about their commitments to ESG and backing that talk with action. ESG criteria give investors a risk lens to evaluate a business or investment’s key ESG-related risks. Companies with strong ESG practices tend to have lower operational costs, less regulatory scrutiny, and improved employee morale, all of which contribute to better financial stability and long-term performance. Conversely, companies with poor ESG practices can face fines, reputational damage, and boycotts, hurting their bottom line.

We have witnessed time and again examples of businesses that have faced intense scrutiny over their ESG practices, such as Meta’s management of consumer privacy (governance), or Amazon facing criticism over its carbon footprint and labor practices. Both companies have taken steps to improve – not necessarily because these are ethically correct things to do but because being more responsible reduces their risk of incurring costly governmental fines; makes them better prepared to manage business risks of climate change (in the example of Amazon); and makes them more relevant to the values of their consumers.

These businesses need to report on their efforts, and the phrase ESG – instantly recognizable and understandable to any investor – is necessary to communicate clearly to investors.

What Businesses Should Do

Talk Openly about ESG

Do not distract your investor relations teams by expecting them to play word gymnastics and flail around for a new phrase to describe how you manage ESG risk. This is counterproductive. Instead, lean into ESG in your communications. Use the storytelling techniques the world’s most successful brands use to build trust with their audiences. Be thoughtful and persuasive, and do not allow yourself to twist in the wind when any blowback happens. Doing that only makes your leadership look weak.

Listen to Investors

Corporate language should cater to investors, not the other way around. As soon as you change the name and call it something else, they will become more suspicious as this is a key decision for them. If you are doing it in order to avoid regulation this is a red flag. All that said, do monitor the terms that investors use and be ready to adapt to how they discuss ESG. In the 21st Century, the term sustainability emerged early on to describe the environmental aspect of ESG. Businesses wisely adopted the term to discuss the topic in more detail. Sustainability and ESG have existed alongside each other since then.

Back Your Words with Actions

As noted, regulators around the world expect businesses to share more evidence that they are managing their ESG impact well, and of course ESG reporting standards from independent bodies proliferate. It is not easy to meet various reporting requirements, but it’s a necessary part of IR. So, prepare for it. Do not shrink back.

IDX can help you do that by creating an authentic ESG narrative that reflects your business needs. Explore our website to learn more about our Investor Relations solutions and download our Sustainability 100 report to learn who does the best job discussing their commitment to the environmental aspect of ESG.

Let's chat

Whether you're looking for service, support or a future strategic partner - we're here to help.

Offices

LDN

London, UK

A mixing pot of every colour, from red buses to black cabs.

Counting House

53 Tooley Street

London

SE1 2QN

GOT

Gothenburg, Sweden

A vibrant city with a rich maritime history.

Hälsingegatan 12

414 63 Gothenburg

Sweden

HEL

Helsinki, Finland

Don’t let the cold scare you off, our office is nice and warm.

Mannerheiminaukio 1 A

FI-00100 Helsinki

Finland

VAD

Vadodara, India

Enter our bustling world of great people and even greater food.

Business Park East, Alembic Road

Vadodara-390003, Gujarat , India

PHX

Phoenix, USA

Visit our oasis in the desert where the sun never stops shining.

11201 N Tatum Blvd, #200

Phoenix, AZ 85028

NYC

New York City, USA

You won’t find a better bagel anywhere else in the world.

240 W 37th Street, 7W

New York, NY 10018